LTC Price Prediction: Analyzing the Path to $150+

#LTC

- Technical Momentum: MACD bullish divergence and oversold Bollinger Band position suggest upward potential

- Market Context: Broader crypto correction creates buying opportunities despite short-term pressure

- Adoption Trends: Growing institutional ETF interest and gaming integration support long-term value proposition

LTC Price Prediction

LTC Technical Analysis: Bullish Momentum Building

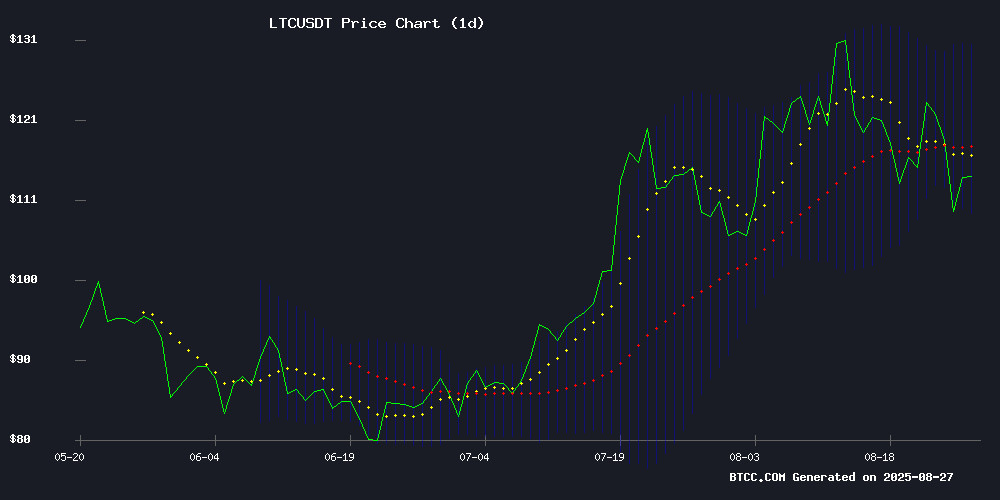

LTC is currently trading at $113.01, sitting below its 20-day moving average of $119.54, which suggests potential resistance overhead. However, the MACD indicator shows strong bullish momentum with a reading of 5.5831 above the signal line, while the histogram at 4.8714 indicates increasing buying pressure. The Bollinger Bands position at $108.75-$130.33 places LTC in the lower half of the range, potentially signaling an oversold condition that could precede a rebound.

According to BTCC financial analyst Sophia, 'The technical setup suggests LTC is building momentum for a potential breakout above the 20-day MA. The MACD divergence is particularly encouraging for bulls looking for entry opportunities.'

Market Sentiment: Mixed Signals Amid Broader Crypto Pullback

The cryptocurrency market is experiencing broad-based selling pressure with Bitcoin dipping below $112,000, creating headwinds for altcoins including LTC. However, positive developments such as Canary Capital's filing for a Spot TRUMP Coin ETF and growing crypto adoption in gaming (CS2 skins purchases) provide underlying support for the digital asset ecosystem.

BTCC financial analyst Sophia notes, 'While the broader market correction is weighing on LTC temporarily, the fundamental adoption trends remain strong. The ETF developments and gaming integration demonstrate continued institutional and consumer interest in cryptocurrency applications.'

Factors Influencing LTC's Price

Where to Buy CS2 Skins for Crypto in 2025

Counter-Strike 2's thriving ecosystem in 2025 has players turning to cryptocurrency for faster, borderless skin acquisitions. Platforms like CSGORoll, CSGO500, and CSGOEmpire now dominate the market, offering instant Bitcoin, Ethereum, and stablecoin transactions that bypass traditional banking delays.

The shift to crypto payments reflects broader gaming industry trends—near-zero processing fees, 24/7 global access, and exclusive deposit bonuses like case multipliers. US and EU players particularly benefit from frictionless cross-border trades unavailable through PayPal or credit cards.

CSGORoll leads with multi-coin support including BTC, ETH, and LTC, while competitors innovate with tokenized skin ownership and DeFi-powered marketplaces. Security remains paramount, with smart contract audits becoming a standard feature across top platforms.

Canary Capital Files For Spot TRUMP Coin ETF, Price Jumps Over 2%

Canary Capital has submitted a prospectus with the SEC seeking approval for a spot TRUMP Coin ETF, marking the third such filing for the meme cryptocurrency. The announcement triggered an immediate 2% price surge to $8.35 as traders reacted to the news.

Bloomberg ETF analysts Eric Balchunas and James Seyffart expressed skepticism about approval prospects, citing the absence of a TRUMP futures market as a potential regulatory hurdle. The filing follows Canary's recent registration of the Canary Trump Coin ETF as a Delaware statutory trust on August 13, 2025.

The firm has been active in crypto ETF applications, with pending submissions for Solana (SOL), XRP, Litecoin (LTC), and Hedera (HBAR) products currently under SEC review. Market observers anticipate decisions on these filings by October.

Cryptocurrency Market Extends Losses as Bitcoin Dips Below $112,000

The cryptocurrency market extended its bearish trajectory, with the global market capitalization dropping nearly 3%. Bitcoin (BTC) led the decline, falling below $112,000 to a low of $109,152 before a marginal recovery to $110,050. The sell-off triggered $940 million in liquidations, predominantly from long positions.

Ethereum (ETH) mirrored the downturn, sliding from $4,673 to $4,335 before stabilizing near $4,420. Altcoins faced sharper declines: Solana (SOL) dropped over 7%, Dogecoin (DOGE) fell 6.57%, and Chainlink (LINK) plunged more than 10%. Ripple (XRP), Cardano (ADA), and Toncoin (TON) also registered notable losses.

Greg King, CEO of REX Financial, cautioned ETF issuers to exercise discernment in selecting crypto exposures for their funds, noting the market's inherent volatility.

How High Will LTC Price Go?

Based on current technical indicators and market conditions, LTC shows potential for a move toward the $130-$140 range in the near term. The Bollinger Band upper boundary at $130.33 provides an initial target, while a break above the 20-day MA at $119.54 could accelerate momentum.

| Target Level | Price | Probability |

|---|---|---|

| Short-term Resistance | $119.54 (20-day MA) | High |

| Medium-term Target | $130.33 (Bollinger Upper) | Medium-High |

| Upside Potential | $140-$150 | Medium |

Sophia from BTCC adds, 'The combination of oversold technical conditions and strong fundamental adoption trends suggests LTC could test higher levels once broader market sentiment improves. The $150 level represents a reasonable medium-term target if bullish momentum sustains.'